business insurance laws credit score dui

business insurance laws credit score dui

What is a detailed insurance deductible? Usually, thorough deductibles range from, as auto insurance policy deductible choices differ depending on your state regulations and also insurance coverage firm standards.

Why you may not want a high comprehensive insurance deductible? A high insurance deductible can mean that you need to pay even more expense in case of a crash or various other covered loss - auto. This can be specifically bothersome if you don't have a great deal of savings or reserve to cover these costs. prices.

As an outcome, you may not be able to get the full quantity of coverage you require if you have a high insurance deductible. Having a greater deductible makes it more difficult to certify for certain discount rates.

The most your insurance will certainly payout is the car's actual cash worth what the auto was worth on the marketplace before the damages occurred minus your selected deductible quantity. You can bargain the real cash money value of your vehicle in the occasion of a complete loss by supplying various examples of comparable automobiles.

Thorough insurance cases and also your rates, A lot of states' insurance laws need that thorough insurance claims be covered by the policy. The rate increase is normally small because thorough claims are not linked to the insurance holder's driving. Unlike obligation or crash cases for crashes, extensive insurance claims generally will not boost your rates. The exemption may be if you submit numerous cases in a very brief time period.

The Ultimate Guide To Michigan's Auto Insurance Law Has Changed

What is an insurance deductible? A deductible is the quantity you pay of pocket towards repair work for your car as a result of a protected loss. For example, if you have a $500 insurance deductible and also you remain in a mishap that causes $3,000 of repair services to your cars and truck, you pay only $500 toward repairs.

cheap car car insured auto insurance auto insurance

cheap car car insured auto insurance auto insurance

In the majority of markets, when you're not liable for a crash, we can waive the deductible if we can determine the various other event, that they're at fault, as well as their insurance policy service provider confirms they have valid responsibility insurance coverage for the crash. This examination can require time, so the deductible might use at the start of the case as well as be reimbursed later - cheap auto insurance.

Your insurance deductible just uses when your insurance company pays for your lorry repair work. There is no insurance deductible if the other event's insurance policy is taking care of the repair services.

car cheap car auto car

car cheap car auto car

Whether you're a new vehicle driver or have been behind the wheel for years, it can be daunting to learn insurance policy terminology like "insurance deductible." Your car insurance policy deductible affects the expense of your insurance, so it is necessary that you choose one very carefully (risks). The deductible that's right for you depends upon your private situations. perks.

If you require to sue with your auto insurance policy supplier after a crash, or when your auto is otherwise harmed, there's an excellent opportunity you'll need to pay a deductible. prices. So, exactly how does an insurance deductible job? A deductible is the amount of money you pay out of pocket before your insurance policy coverage starts and starts paying for the costs of your loss.

The Basic Principles Of What Exactly Is An Auto Insurance Deductible?

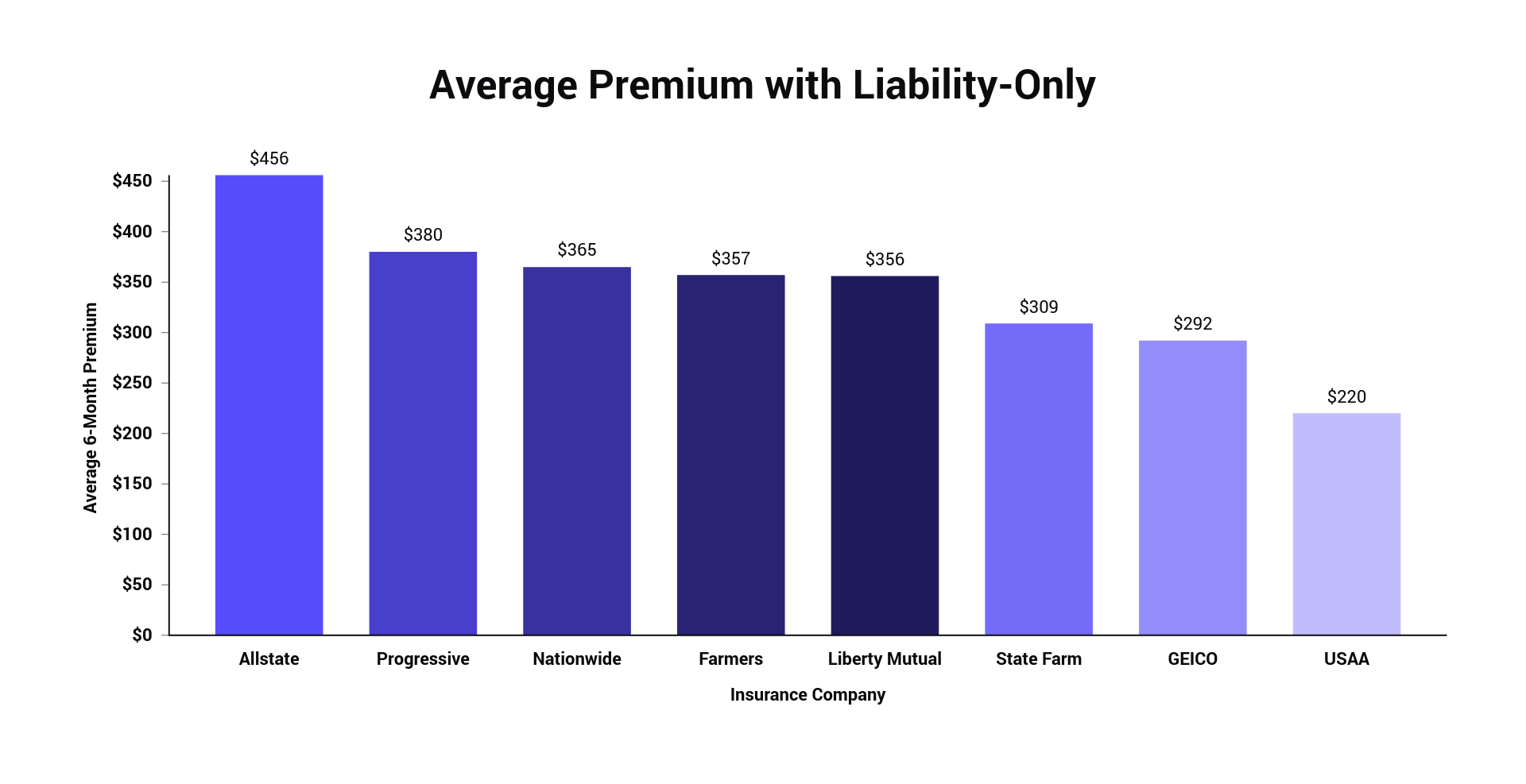

Not all insurance coverage coverages call for an insurance deductible, however if your own does, you'll pick the amount. Your deductible will affect your month-to-month insurance coverage repayment the lower your insurance deductible, the higher your car insurance premium. When buying quotes from car insurer, explore exactly how various deductibles will impact your regular monthly repayments.

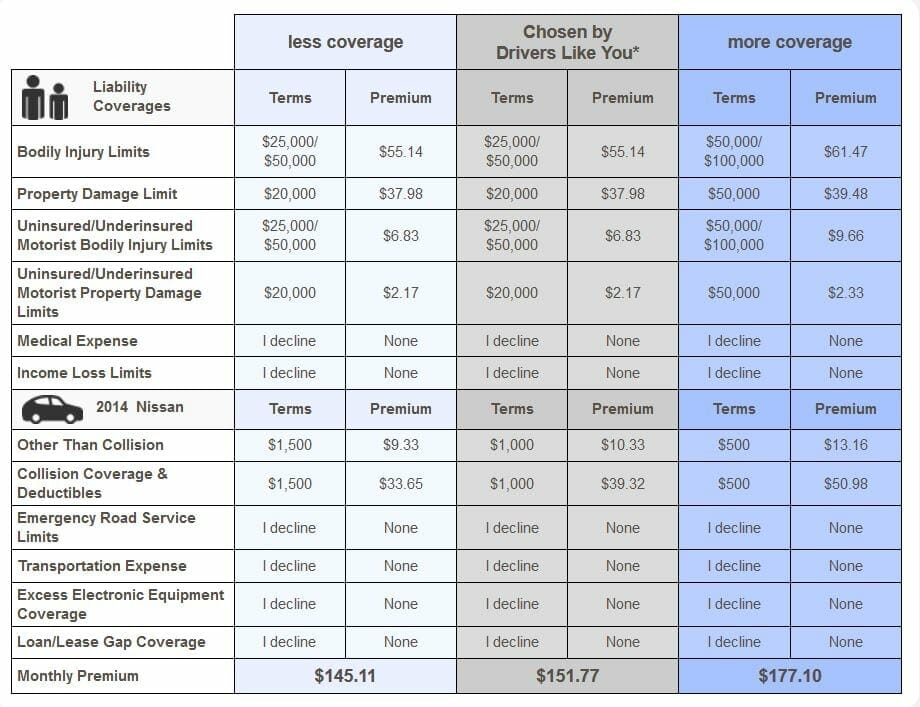

Auto insurance policies can include different types of coverage that offer differing purposes, and you can select to be covered by some or all of them. State legislation usually establishes whether or not an insurance deductible is needed.

This covers you if your automobile clashes with another car or item and you require to pay for repairs. cheap car. Collision deductibles are standard however vary by insurance company. If your automobile is damaged by an event such as fire, a falling things striking your windshield or criminal damage, you'll file an extensive insurance coverage insurance policy claim.

dui vehicle business insurance dui

dui vehicle business insurance dui

low cost car insured insure affordable auto insurance

low cost car insured insure affordable auto insurance

Deductibles are often needed for this insurance coverage, yet not constantly, as well as needs differ by state. While your car insurance policy deductible can differ significantly depending on lots of elements, consisting of exactly how much you desire to pay, cars and truck insurance deductibles typically range from $100 to $2,500.

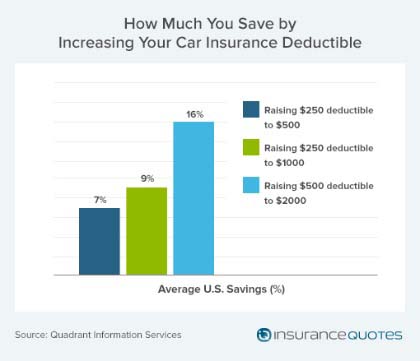

When selecting a deductible, you'll need to take into consideration several factors, including your spending plan (auto). Spend time calculating how much you can afford to spend for an insurance deductible as well as how much you'll minimize your regular monthly premiums by going with a greater one. Ask yourself these questions when selecting a deductible quantity.

4 Easy Facts About Should I Have A $500 Or $1000 Auto Insurance Deductible? Explained

You require this barrier in situation the worst takes place, however if you're a safe chauffeur or do not drive frequently, making use of an emergency fund to cover any crashes may be a choice. This is a crucial concern when considering what insurance deductible to pick. If you enter a mishap, can you afford the deductible or would you have a hard time to pay it? Handling a high insurance deductible may not make much feeling if it represents a big section of the vehicle's worth.

Anytime you remain in an automobile accident and also there are problems to your car that would be covered under extensive or collision protections, you'll be in charge of paying the deductible under each of those insurance coverages. You can pick various deductibles within your car insurance coverage policy for both crash as well as detailed. If you have multiple cars and trucks on your car insurance coverage, you can additionally pick different deductibles for every cars and truck.

You can choose different insurance coverage restrictions for every one of them, in addition to set deductibles, depending upon which protection it is. car insured. Why can not you always pick your deductible? Because not all insurance coverages have them and some, like Injury Security, have them in some states, and not others. Deal with your insurance company to establish just how to fulfill your coverage requires.

Because they aren't responsible for as much cash, they have less risk. So they charge a reduced cars and truck insurance premium. Basically, a higher insurance deductible equates to lower insurance coverage costs. A lower deductible amounts to higher insurance coverage costs. An example would be an insurance plan with a $500 accident deductible.

This falls under crash insurance coverage. When picking vehicle insurance coverage, you Discover more here picked the low deductible of $500. The insurance firm would certainly now need to pay $9,500. But what if you selected a high insurance deductible of $2,500? After that the insurance firm would just need to pay $7,500. They have less danger, so you'll pay a reduced costs.